Effective risk management involves not only implementing security measures but also establishing governance processes that form a unified structure for mitigating risks. The Three Lines Model provides a cohesive framework where governing bodies work together at every level of the organization to successfully manage and mitigate risks. Here’s how you can incorporate the Three Lines Model into your organizational structure and processes and harness the capabilities of the 6clicks platform to build a robust risk and compliance management program:

What is the Three Lines Model?

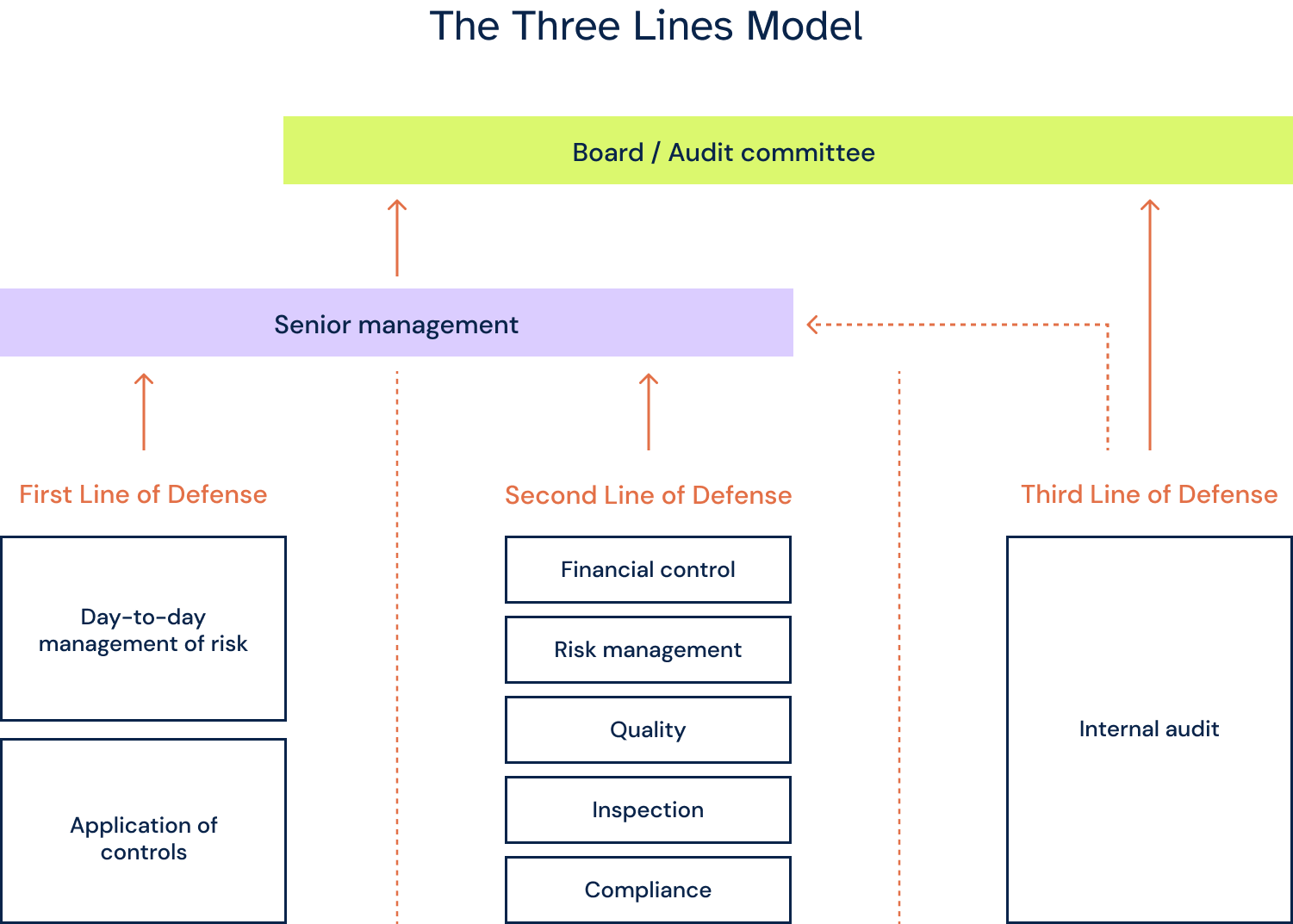

The Three Lines Model, previously known as the Three Lines of Defense, was developed by the Institute of Internal Auditors to guide the effective management and governance of risk. It is a multi-layer framework that establishes three levels of governing bodies that are tasked with planning, implementing, monitoring, and improving risk management activities within the organization.

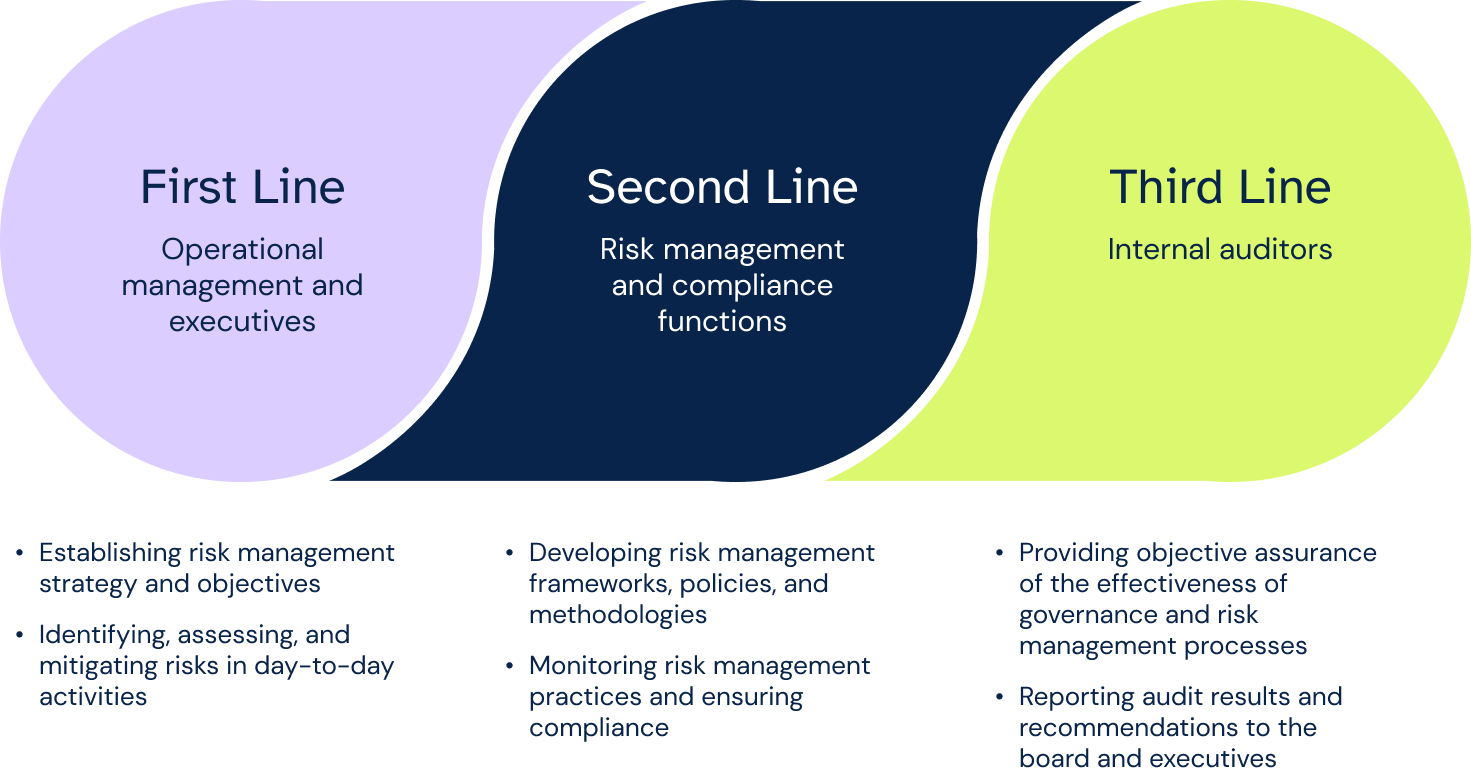

First line: Operational management and executives

The first line of defense consists of both operational management and executives. Executives are responsible for establishing the organization's risk management strategy, defining risk appetite, and clearly communicating risk management objectives to operational management. Operational management, including frontline managers and staff, then bear the responsibility for identifying, assessing, and mitigating the risks inherent in their day-to-day activities and areas of responsibility. They implement internal controls, allocate resources and assign actions for risk treatment, and provide timely risk information to the second line.

Second line: Risk management and compliance functions

The second line of defense comprises the specialized risk management and compliance functions within the organization. These units provide independent oversight and support to the first line in managing risks. Their key responsibilities include developing and enhancing the risk management frameworks, policies, and methodologies that guide the first line's activities. The second line also monitors the implementation and effectiveness of the first line's risk management practices and internal controls and ensures their compliance with regulatory requirements.

Importantly, the first and second lines of defense work together to foster a strong risk management culture across the organization. This involves promoting risk awareness, assigning clear accountability, and ensuring roles and responsibilities for risk management are well-defined and communicated.

Lastly, the second line aggregates risk information from across the organization to provide senior management and the board with an objective, enterprise-wide view of the company's risk profile. They also advise the business on emerging risks and appropriate mitigation strategies to ensure alignment with the overall risk management framework.

Third line: Internal auditors

The third line of defense in the risk management model is the internal audit function. This group provides independent and objective assurance of the appropriateness, adequacy, and overall effectiveness of the organization's governance, risk management, and internal control processes.

The key responsibilities of internal auditors include evaluating the design and operational effectiveness of the risk management framework, including the activities of both the first and second lines of defense. They also assess the reliability of financial and operational information, review compliance with policies and regulations, and provide consulting services to improve the organization's operations. Internal auditors report their audit results, conclusions, and recommendations directly to the board of directors and senior management. By operating independently from the business units and management, internal auditors are able to offer a fresh, unbiased perspective on the organization's risk and control environment. This allows leadership to obtain reliable assurance that the first and second lines of defense are operating effectively. The insights from internal audits are crucial inputs that enable the organization to continuously improve its risk management practices.

External auditors

The Three Lines Model also emphasizes the role of an external audit in complementing internal audits. Aside from providing assurance of the efficacy of controls and processes, external auditors can verify the organization’s compliance with regulatory requirements.

Overall, the Three Lines Model offers an effective approach for implementing and improving an organization’s risk management process and cultivates a culture of collaboration and accountability.

Leveraging the Three Lines Model with 6clicks

From establishing risk and compliance management processes to completing internal audits and generating board-ready reports, the 6clicks platform can support various risk and compliance activities and aid your organization in building its lines of defense.

6clicks’ multi-tenant Hub & Spoke architecture allows you to flexibly deploy separate environments for your teams or divisions called ‘Spokes.’ From a centralized control ‘Hub,’ you can then define your risk management procedures through best-practice content such as internal controls and audit templates and distribute them to your Spokes. You can also set up your workflows and use our custom fields to ensure consistency across your entire organization, automate your processes, and drive better outcomes for your risk and compliance program.

6clicks’ IT Risk Management solution empowers your risk managers with a comprehensive Risk Register, custom risk workflows, and integrated risk assessments and treatment plans, enabling them to seamlessly manage and track the entire risk lifecycle. Risks, treatment plans, and control tasks can also be assigned to frontline managers for action tracking and ensuring proper implementation. Meanwhile, 6clicks’ Security Compliance solution equips your compliance managers with powerful capabilities such as policy and control management, automated compliance mapping, and policy gap analysis to streamline compliance monitoring and evidence collection.

Internal auditors can then kick off audits using built-in templates from 6clicks’ Audits and Assessments module. Using data from past assessments, 6clicks’ AI engine Hailey can instantly generate new responses and accelerate the audit process.

Finally, all three lines can leverage our Reporting & Analytics capability, featuring an easy-to-use dashboard and one-click report generator called Pixel Perfect, to gain critical insights and fulfill their respective responsibilities with enhanced efficiency.

Build a robust IT risk management and security compliance program with 6clicks

Utilize the cutting-edge capabilities of the 6clicks platform and adapt the Three Lines Model to your organization to stay resilient amidst evolving risks.

Frequently asked questions

What are the Three Lines of Defense?

The Three Lines Model, previously known as the Three Lines of Defense, is a framework developed by the Institute of Internal Auditors to guide effective risk management and governance. It establishes three levels of governing bodies within an organization to plan, implement, monitor, and improve risk management activities.

Who constitutes the first line of defense?

The first line of defense includes operational management and executives. Executives set the risk management strategy and communicate objectives, while operational management identifies, assesses, and mitigates risks in their daily activities.

What is the role of the second line of defense?

The second line comprises specialized risk management and compliance functions. They support operational management by providing independent oversight, developing risk management frameworks, monitoring implementation, ensuring compliance, and aggregating risk information for senior management.

What is the responsibility of the third line of defense?

The third line consists of internal auditors who provide independent assurance of governance, risk management, and internal control processes. They evaluate effectiveness, assess compliance, and offer recommendations for improvement directly to the board and senior management.

Written by Louis Strauss

Louis is the Co-founder and Chief Product Marketing Officer (CPMO) at 6clicks, where he spearheads collaboration among product, marketing, engineering, and sales teams. With a deep-seated passion for innovation, Louis drives the development of elegant AI-powered solutions tailored to address the intricate challenges CISOs, InfoSec teams, and GRC professionals face. Beyond cyber GRC, Louis enjoys reading and spending time with his friends and family.