Definition of risk management framework (RMF)

A Risk Management Framework (RMF) is a structured process that enables organizations to identify, assess, and mitigate risks in a systematic and effective manner. It provides a comprehensive approach to risk management, enabling organizations to proactively address potential threats and uncertainties that can impact their operations. The framework is designed to be adaptable and applicable to organizations of all sizes and across different industries. By implementing a risk management framework, organizations can enhance their ability to make informed decisions, protect their assets, and achieve their objectives while minimizing potential negative outcomes. The key components of a risk management framework typically include risk identification, risk assessment, risk mitigation strategies, and risk reporting. It provides a structured and consistent approach to managing risks, ensuring that organizations have a clear understanding of their risk universe and the necessary controls and processes in place to effectively manage them. By integrating risk management into their business operations, organizations can better navigate the complexities and uncertainties of today's fast-paced and ever-changing business landscape.

Purpose of RMF

The purpose of an RMF is to provide a structured process for identifying, managing, and monitoring risks within an organization.

The key role of an RMF is to enable the systematic identification and assessment of potential risks that may impact the business operations, resources, or assets. By implementing an RMF, organizations can proactively identify and analyze the various risks they face, such as cybersecurity risks, supply chain risks, legal risks, and strategic risks.

Furthermore, an RMF facilitates the development of risk management strategies and the implementation of appropriate risk mitigation measures. This ensures that organizations are prepared to respond effectively to potential risks, minimize their impact, and protect their reputation.

Another important aspect of an RMF is providing a comprehensive framework for reporting and tracking risks. This enables organizations to communicate risk-related information to stakeholders, such as management, board members, and auditors. It also assists organizations in meeting compliance requirements, such as those outlined in the Sarbanes-Oxley Act, which mandates internal control assessments and reporting.

The purpose of an RMF is to establish a structured and systematic approach to risk identification, management, reporting, and monitoring. It helps organizations effectively address risks, comply with various regulations, and improve overall risk governance.

The RMF steps

A comprehensive RMF enables organizations to effectively identify, assess, and mitigate risks across various areas, including cybersecurity, supply chain, legal, and strategic risks. The RMF Steps involve a series of systematic actions that organizations undertake to manage risks effectively. These steps typically include risk identification, risk assessment, mitigation, monitoring, and reporting. By following these steps, organizations can comprehensively understand their risk landscape, develop targeted mitigation strategies, and ensure ongoing monitoring and reporting of risks to stakeholders. This enables organizations to proactively manage and minimize their exposure to potential threats, protect valuable assets, and maintain a strong risk management program.

Risk identification

Risk identification is a crucial step in the risk management framework that organizations must undertake to protect their information systems. It involves defining the parameters of the entire threat landscape and identifying all possible risks that could potentially impact an organization's operations.

When it comes to risk identification, organizations must consider a wide range of factors. First, they need to thoroughly assess threats that could arise from external sources, such as cyber-attacks or natural disasters. They should also analyze internal factors, including IT systems vulnerabilities and operational risks.

Another important aspect of risk identification is understanding the potential impact of these risks. Organizations need to determine the level of impact a risk might have on their operations and prioritize accordingly.

Furthermore, risk identification also involves considering regulatory risks. Organizations need to be aware of the compliance requirements specific to their industry or sector and identify any risks associated with non-compliance.

In conclusion, risk identification is a crucial process within the risk management framework that helps organizations define and understand the threats and vulnerabilities present in their information systems. Organizations can develop effective risk mitigation strategies to protect their assets and operations by identifying and understanding these risks.

Risk assessment and analysis

Risk assessment and analysis are crucial in the risk management framework, enabling organizations to prioritize and effectively mitigate potential risks. This process involves calculating and ranking the identified risks based on their threats, vulnerabilities, impact, likelihood, and predisposing conditions.

To calculate risks, organizations need to consider the probability of a specific threat occurring and its potential impact on their operations. This involves examining historical data, industry trends, and expert opinions to estimate the likelihood of an event taking place.

Vulnerabilities also play a significant role in risk assessment. Organizations must identify weaknesses in their systems, processes, or controls that a threat could potentially exploit. By understanding vulnerabilities, they can assess the likelihood of a risk materializing.

The impact of a risk is another important factor to consider. This involves evaluating the potential consequences and losses that may occur if a risk eventuates. The impact can range from financial losses to reputational damage or even legal ramifications.

Likelihood and predisposing conditions refer to the probability that a risk event will occur and the factors that increase the likelihood of the risk happening. By analyzing these variables, organizations can determine the level of risk posed by specific threats and prioritize their risk mitigation efforts accordingly.

Strategic risks, such as compliance, financial, and legal risks, must also be considered during the risk assessment process. Compliance risks relate to non-compliance with regulations or industry standards, which could lead to penalties or legal consequences. Financial risks involve potential monetary losses or instability. Legal risks arise from potential disputes or litigations that could impact the organization's operations.

Technology-related risks, including IT, operational, and data breach risks, are also important to assess. IT risks refer to threats related to information technology systems, such as cyber-attacks or system failures. Operational risks involve potential disruptions to business operations. Data breach risks pertain to the compromise or unauthorized access to sensitive data.

By effectively assessing and analyzing risks, organizations can comprehensively understand their risk landscape and implement appropriate risk mitigation strategies.

Risk evaluation

Risk evaluation is critical in the risk management framework as it helps organizations prioritize and allocate resources effectively. To calculate and rank the identified risks, organizations need to consider two key factors: the likelihood of an adverse event occurring and its potential impact on the business.

Organizations analyze historical data, industry trends, expert opinions, and any available risk assessment tools or models to calculate risks. By considering these inputs, organizations estimate the probability that a specific threat or event will occur. This involves assessing the likelihood of various risk factors, such as vulnerabilities, predisposing conditions, and strategic risks.

Once the likelihood has been determined, organizations evaluate each risk event's potential impact on the business. Impact analysis considers the range of consequences and losses that may arise, including financial, reputational, operational, or legal implications.

Risk can be ranked or prioritised based on the calculated likelihood and impact. Some organizations use a scoring system to assign numerical values to risks, while others categorize risks into high, medium, or low categories. This ranking helps organizations identify the most critical risks that require immediate attention and allocation of resources.

By conducting a comprehensive risk evaluation, organizations can optimize their risk management efforts by first addressing high-likelihood, high-impact risks while efficiently allocating resources to mitigate potential losses and protect their business operations.

Risk mitigation and control

Risk mitigation is the process of implementing strategies and actions to reduce or eliminate the likelihood and impact of identified risks. It is a crucial component of a comprehensive risk management framework that allows organizations to protect their assets, reputation, and bottom line.

One of the key steps in risk mitigation is identifying and assessing the risks. This involves thoroughly analysing the organization's operations, systems, and processes to identify any vulnerabilities or potential threats. By understanding the specific risks the organization faces, mitigation efforts can be targeted effectively.

Once risks have been identified, organizations develop and implement risk mitigation strategies. These strategies can vary depending on the type of risk. For example, in cybersecurity risk management, organizations might implement security controls, such as firewalls, encryption, and intrusion detection systems, to protect their networks and data from cyber threats.

In supply chain risk management, organizations might diversify their suppliers or establish contingency plans to minimize the impact of disruptions in the supply chain. Legal risks can be mitigated through comprehensive compliance programs and the implementation of robust policies and procedures.

Implementing risk controls is another crucial aspect of risk mitigation. Controls are measures put in place to manage and reduce risks. These can include technology solutions, process changes, training programs, and regular monitoring and assessments. Controls should be regularly reviewed and updated to ensure their effectiveness in mitigating risks.

Effective risk mitigation also requires a proactive approach to monitoring and managing risks on an ongoing basis. Organizations need to regularly review and reassess their risk landscape and adjust their mitigation strategies accordingly. This includes monitoring industry trends, regulatory requirements, and emerging risks to ensure that mitigation efforts are up to date and aligned with current threats.

Furthermore, communication and reporting are essential in risk mitigation and control. Organizations should establish processes to keep stakeholders informed about the progress of risk mitigation efforts and any changes to the risk landscape. This transparency helps build trust and ensures that everyone understands the organization's commitment to managing and mitigating risks.

Risk mitigation and control are integral parts of an effective risk management framework. Organizations can reduce the likelihood and impact of potential threats by identifying, assessing, and implementing strategies to mitigate risks. This not only protects the organization's assets and reputation but also helps ensure its long-term success in an increasingly uncertain business landscape.

Risk monitoring and review

Risk monitoring and review are essential components of a robust risk management framework. These processes ensure that organizations stay vigilant and proactive in identifying and assessing risks, allowing them to take appropriate actions to mitigate them.

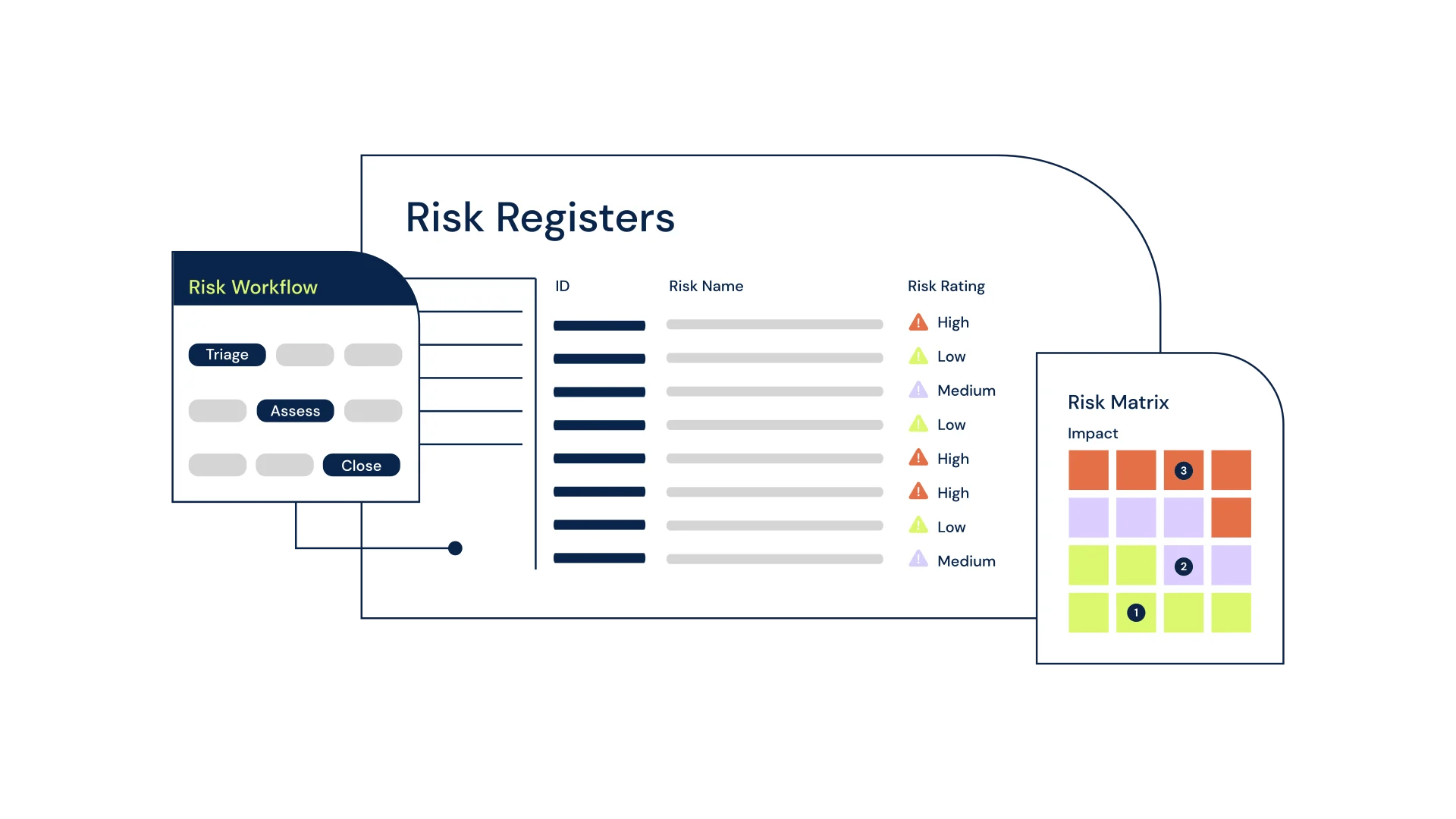

One crucial aspect of risk monitoring is maintaining a comprehensive list of known risks. This list should include all potential threats that the organization has already identified through risk assessment processes. By having a centralized repository or risk register of known risks, organizations can easily track and monitor their exposure to these risks over time.

Regularly reviewing this list is equally important. Organizations should conduct periodic risk reviews to ensure that the identified risks are still applicable and relevant. Risk landscapes are dynamic, and new risks may emerge while existing risks may evolve. By conducting regular reviews, organizations can identify any changes in the risk landscape and update their mitigation strategies accordingly.

In addition to monitoring known risks, organizations should also monitor their compliance with policies and procedures. This ensures that the organization's risk mitigation efforts align with its objectives and comply with regulatory requirements. By regularly assessing compliance, organizations can identify any gaps or weaknesses in their risk management practices and take corrective actions to address them.

Reporting all successful attacks is another critical aspect of risk monitoring and review. Sharing information about successful attacks helps other organizations in the industry understand the tactics and techniques used by threat actors. This sharing of information can help peers fortify their own defenses and prevent similar attacks in the future. Moreover, reporting successful attacks promotes transparency and accountability, fostering a security-conscious culture within the industry.

Risk monitoring and review are vital for organizations to stay proactive and resilient in the face of evolving threats. Organizations can ensure that their risk management practices are effective and aligned with industry best practices by maintaining a list of known risks, regularly reviewing them, monitoring compliance, and reporting successful attacks.

Communication and reporting

Communication and reporting play a crucial role in the RMF process. They enable organizations to monitor and manage risks effectively, ensure transparency and accountability, and inform decision-making at all levels.

One important aspect is the timely and accurate reporting of risk-related information. Regular reporting provides stakeholders with a comprehensive view of the organization's risk landscape, including known risks, risk mitigation strategies, and any emerging threats. This allows stakeholders to stay informed and make informed decisions based on the most up-to-date information available.

Real-time dashboards and automated reporting systems are valuable tools in this process. These systems provide organizations with a centralized and automated way to collect, analyze, and present risk data meaningfully and visually. Real-time dashboards offer a snapshot of the organization's risk profile, allowing stakeholders to quickly identify and address potential areas of concern. Automated reporting saves time and resources by streamlining the process of generating reports, ensuring regular and consistent reporting without the need for manual intervention.

Additionally, it is essential to communicate the outcomes of risk monitoring to relevant stakeholders, such as senior leadership or the board of directors. Senior leaders need to understand the organization's risk exposure and the effectiveness of risk mitigation efforts to make informed strategic decisions. Transparent and concise reporting of risk outcomes enables senior leadership to prioritize resources and take necessary actions to address identified risks.

Effective communication and reporting are vital components of the Risk Management Framework process. They facilitate timely and accurate reporting of risk-related information, enable real-time monitoring through dashboards and reporting tools, and inform decision-making at all levels of the organization. Organizations can effectively manage risks and protect their assets and reputation by ensuring transparency and accountability.

Risk culture and training

Risk culture and training play a crucial role in an organization's risk management framework. They contribute to the effective implementation of risk mitigation strategies and the overall success of the risk management program.

One key element of risk culture is employee awareness and engagement. A strong risk culture ensures that all employees understand the importance of risk management and their individual roles and responsibilities in identifying and mitigating risks. By fostering a culture that prioritizes risk awareness, organizations can create a proactive environment where employees are more likely to identify potential risks and take the necessary steps to mitigate them.

Training is essential in enhancing risk management competencies within an organization. By providing comprehensive training programs, organizations can ensure that their employees have the knowledge and skills to effectively identify, assess, and respond to risks. Training can cover various areas, such as risk assessment methodologies, risk identification techniques, and the implementation of risk mitigation strategies. It also helps to reinforce the organization's risk culture and ensure that risk management practices are consistently applied across different levels and functions.

By integrating risk culture and training into their risk management framework, organizations can establish a solid foundation for effective risk management. This includes promoting a culture where risk awareness is valued and providing employees with the necessary knowledge and skills to identify and address risks. Together, these factors contribute to the successful implementation of risk mitigation strategies and the overall effectiveness of the organization's risk management program.

Risk management standards and frameworks

NIST Risk Management framework

The NIST Risk Management Framework (RMF) is a federal guideline established by the National Institute of Standards and Technology (NIST) to assess and manage risks to technology. It provides a structured approach to identify, analyze, and prioritize risks, enabling organizations to make informed decisions and implement appropriate security controls.

The NIST RMF is highly significant as it serves as a comprehensive risk management framework in federal agencies and private companies. It helps organizations understand and address potential vulnerabilities and threats to their systems, ensuring information confidentiality, integrity, and availability.

By following the NIST RMF, organizations can effectively manage risk by implementing security controls and continuously monitoring their effectiveness. This proactive approach to risk management reduces the likelihood and impact of security breaches, data loss, and other cybersecurity incidents.

The NIST RMF helps organizations adapt to changing technologies, evolving threat landscapes, and regulatory requirements. It emphasizes continuous improvement and provides a structured risk identification, assessment, mitigation, and monitoring process.

The NIST Risk Management Framework is vital for organizations to assess and manage risks to their computer and information systems. By adhering to this framework, organizations can enhance their security posture, protect sensitive information, and maintain business resilience in today's dynamic threat landscape.

ISO 31000: International standard for risk management

ISO 31000 is an internationally recognized standard for risk management that provides organizations with guidelines and principles to effectively manage risks and uncertainties. This standard plays a crucial role within the RMF as it establishes a common understanding of risk management concepts and practices.

ISO 31000 emphasizes the importance of integrating risk management into all organizational processes. It provides a systematic and structured approach to identify, assess, and mitigate risks, helping organizations make informed decisions and take appropriate actions to achieve their objectives.

Key concepts and principles of ISO 31000 include risk ownership, risk identification, risk analysis, risk evaluation, and risk treatment. These concepts ensure that risks are properly identified and assessed, enabling organizations to prioritize resources and implement suitable risk mitigation strategies.

By incorporating ISO 31000 into the RMF, organizations can enhance their risk management practices. This standard promotes a proactive and systematic approach to risk management, enabling organizations to effectively respond to uncertainties and adapt to changing environments. Implementing ISO 31000 can also improve transparency and accountability, as it encourages organizations to communicate and consult stakeholders throughout the risk management process.

ISO 31000 is an international standard that enhances risk management practices within the RMF. By following its principles and concepts, organizations can better identify, assess, and mitigate risks, ultimately achieving their objectives and ensuring long-term success.

NIST vs. ISO 31000: A comparative analysis

NIST RMF and the ISO 31000 Standard Framework are two widely recognized and adopted approaches to risk management. While they share common goals, they differ in their approach, scope, industry applicability, and focus areas.

The NIST RMF is primarily focused on information security and is widely used by organizations, particularly in the United States, for managing cybersecurity risks. It provides a structured process for organizations to manage and mitigate risks to their systems and data. It consists of six steps - categorization, selection, implementation, assessment, authorization, and ongoing monitoring - that help organizations identify, assess, and manage risks effectively. The NIST RMF is commonly used in government agencies, defense organizations, and other industries with a strong emphasis on cybersecurity.

On the other hand, the ISO 31000 Standard Framework takes a broader approach to risk management. It is applicable to all types of risks that an organization may face, such as strategic, operational, financial, and compliance risks. ISO 31000 provides a flexible and adaptable framework that emphasizes a proactive approach to risk management. It focuses on the entire risk management process, including risk identification, assessment, treatment, and monitoring. ISO 31000 is widely applicable across various industries and organizations, irrespective of their size, sector, or location.

In terms of scope, the NIST RMF primarily focuses on managing risks related to information security and cybersecurity. It provides specific guidelines and control objectives for securing information systems and protecting sensitive data. In contrast, the ISO 31000 Standard Framework covers a wide range of risks faced by organizations, beyond just cybersecurity. It encourages organizations to adopt a holistic approach to risk management and integrate it into their overall governance and decision-making processes.

Both the NIST RMF and the ISO 31000 Standard Framework offer valuable approaches to risk management, but their focus and scope differ significantly. The NIST RMF is more specific to the management of information security and cybersecurity risks, while ISO 31000 provides a broader and more adaptable framework for managing all types of risks faced by organizations. Organizations should carefully assess their specific needs and choose the framework that aligns best with their industry, risk profile, and overall risk management objectives.

How software helps

Risk management software is a powerful tool that can greatly enhance an organization's risk management framework. By leveraging automation and advanced capabilities, it streamlines manual processes, provides predictable and consistent results, and enables continuous monitoring of controls.

One of the key benefits of risk management software is its ability to streamline processes. It automates repetitive and time-consuming tasks, such as data collection, analysis, and reporting, eliminating the need for manual intervention. This significantly reduces the administrative burden on risk management teams and allows them to focus on more critical activities, such as risk identification and mitigation.

Moreover, risk management software ensures consistent results. It enforces standardized risk assessment methodologies and documentation templates, enabling organizations to maintain a consistent approach to risk management across different departments or business units. This ensures that risks are assessed and treated in a systematic and reliable manner, minimizing the potential for errors and inconsistencies.

Continuous monitoring of controls is another valuable feature of risk management software. It provides real-time visibility into the effectiveness of implemented controls and alerts organizations to any deviations or potential risks. This enables proactive risk management by identifying emerging threats and vulnerabilities, allowing organizations to take immediate action to mitigate them before they become actual incidents.

Furthermore, automation in risk management software allows for seamless mapping of controls to the chosen risk management framework. This integration reduces the time spent on mapping controls manually and ensures that the organization's risk management activities align with the defined framework. This not only improves efficiency but also enhances the quality and accuracy of risk assessments and reporting.

Risk management software plays a critical role in enhancing an organization's risk management framework. By streamlining processes, providing consistent results, enabling continuous monitoring, and automating control mapping, it greatly improves efficiency and effectiveness in managing risks. Organizations that leverage risk management software can benefit from improved risk visibility, informed decision-making, and better protection against potential threats.

Tips and tricks

Tips & Tricks for Implementing and Managing a Risk Management Framework

Implementing and managing a risk management framework can be a complex task. However, by following some practical recommendations and strategies, organizations can enhance their risk identification, measurement, mitigation, reporting, monitoring, and governance. Here are some valuable tips and tricks to consider:

- Clearly define and communicate objectives: Ensure that the objectives of the risk management framework are clearly defined, communicated, and understood by all stakeholders. This will provide a common understanding of the purpose and goals of the framework, aligning efforts towards effective risk management.

- Involve key stakeholders: Engage key stakeholders from different departments or business units in the risk identification process. Their participation and expertise will enhance the accuracy and comprehensiveness of risk assessments.

- Adopt a structured risk assessment process: Implement a structured and consistent risk assessment process to ensure comprehensive identification and measurement of risks. This process should include qualitative and quantitative analysis techniques, allowing for a deeper understanding of risks and their potential impact.

- Develop robust risk mitigation strategies: Implement proactive risk mitigation strategies to effectively manage identified risks. These strategies should be tailored to the specific risks faced by the organization and incorporate a combination of preventive and reactive controls.

- Real-time risk reporting and monitoring: Implement a system for real-time risk reporting and monitoring. This ensures that risks are continuously tracked, trends are identified, and timely actions are taken to mitigate emerging threats.

By following these tips and tricks, organizations can enhance the effectiveness of their risk management framework. This will enable them to proactively identify, measure, mitigate, report, and monitor risks, ultimately contributing to better risk governance and decision-making processes.

Final thoughts

Selecting the appropriate RMF is of utmost importance for any organization as it can have a significant impact on its operational processes. A well-designed and implemented RMF can provide numerous benefits, including improved risk identification and assessment, enhanced decision-making, and a more proactive approach to risk mitigation.

When embarking on the journey of selecting an RMF, careful planning, preparation, and analysis are crucial. It is essential to thoroughly evaluate and compare the qualities of different frameworks against the organization's specific goals and objectives in implementing an RMF. This ensures that the chosen framework aligns with the organization's risk appetite, industry requirements, and operational needs.

By selecting an appropriate RMF, organizations can streamline their risk management processes and gain insights into their risk exposure, enabling them to make informed decisions to protect their assets and maintain business continuity. An effective RMF can also provide the necessary structure, tools, and methodologies to identify and evaluate emerging risks, enabling organizations to proactively address potential threats before they escalate.

Ultimately, the proper selection of an RMF allows organizations to embed risk management as a core component of their business operations, leading to greater strategic agility, improved stakeholder confidence, and a proactive management approach customized to their specific goals and objectives.

At 6clicks, we bring all activities related to risk management to a single platform. The platform makes implementing risk management easy, from ready-to-use content to intelligent automation.

Written by Louis Strauss

Louis began his career in Berlin where he also founded Dobbel Berlin – Berlin’s curated search engine. Returning to Melbourne to join KPMG, Louis lead the development of software designed to distribute IP and create a platform for us by advisors and clients. While at KPMG, Louis also co-authored Chasing Digital: A Playbook for the New Economy. Louis is accomplished in stakeholder management, requirements gathering, product testing, refinement and project implementation. Louis also holds a Bachelor of Engineering and a Masters of Information Systems from the University of Melbourne.