The operation of a business at any level, in any department, involves risk. Therefore, it is crucial that every person in an organisation understands the various risks associated with their range of responsibilities and becomes involved as the company deals with these risks, together.

We get it, that's a pretty big cross to bear. For now, let's just tackle an area of confusion for many - business risk and financial risk.

Recognising what separates these risks will help any organisation better understand their business environment. Conversely, how the two risk domains work parallel to each other is especially relevant for maintaining business continuity.

Also, risk assessments play a crucial role in gaining a comprehensive understanding of various risks, potential risk events, and the potential harm they can cause. By conducting thorough risk assessments, organizations can effectively optimize their company performance while minimizing and mitigating unnecessary risks.

Below, we will unpack the two, highlight some of the key differences and provide potential solutions to address them both.

What is Business Risk?

Business risk relates to the uncertainties and potential drawbacks inherent in a company's operations and industry environment. It encompasses a wide range of factors that may impact a company's ability to achieve its objectives and generate profits. Some key points about business risk include:

- Nature: Business risk is primarily associated with the nature of a company's operations, such as its products, services, market demand, competition, technological changes, and regulatory environment.

- Impact: Business risk can affect the company's revenue, market share, reputation, operational efficiency, and overall business viability.

- Management: Business risk can be managed through strategic decisions, diversification, market research, innovation, effective supply chain management, and adaptation to changing market conditions.

- Examples: Examples of business risks include shifts in consumer preferences, new competitors entering the market, economic recessions, natural disasters, and changes in government policies or regulations.

To make this exciting area even more fun, business risk happens to be divided into two other categories. Systematic and unsystematic.

- Systematic risk is the result of a downturn that an entire industry or economy faces. It is caused by factors such as inflation, volatile interest rates and natural disasters - and there's not much that you can really do about it.

- Unsystematic risk, however, is a result of poor management decisions, investments or strategic moves for example.

To reduce such risks, large organisations tend to diversify their portfolios, i.e. when one company is experiencing a downturn, it can be overcome by the favourable performance of another.

What is Financial Risk?

Investing and running a business always come with inherent risks. Financial risk, specifically, is a type of risk associated with investments and refers to the possibility that a company's cash flows may not be sufficient to meet its financial obligations, as explained by Dun and Bradstreet.

Financial risk refers to the possibility of loss or negative impact on a company's financial position or its ability to meet its financial obligations. It is primarily associated with the structure of a company's capital and its financial decisions.

Financial risks encompass a range of factors, including credit risk, funding liquidity risk, asset-backed risk, foreign investment risk, profitability risk, third-party risk, regulatory risk, and economic risk. These risks have the potential to significantly affect a business's profitability. Liquidity, asset-backed, and foreign investment risks, in particular, can have a direct impact on the financial well-being of a company.

Based on this, financial risk can be categorized into different types, including market risk, credit risk, liquidity risk, operational risk, and legal risk, based on the factors mentioned earlier.

Some key points about financial risk include:

- Capital Structure: Financial risk relates to the mix of debt and equity financing in a company's capital structure. Higher levels of debt increase financial risk.

- Impact: Financial risk can affect a company's profitability, cash flow, solvency, and creditworthiness. It may also limit a company's ability to access funding or increase its cost of borrowing.

- Management: Financial risk can be managed through prudent financial planning, effective cash flow management, maintaining an optimal capital structure, hedging strategies, and diversification of funding sources.

- Examples: Examples of financial risks include high levels of debt, interest rate fluctuations, foreign exchange rate volatility, credit risk (default by customers or suppliers), liquidity risk, and inadequate financial controls.

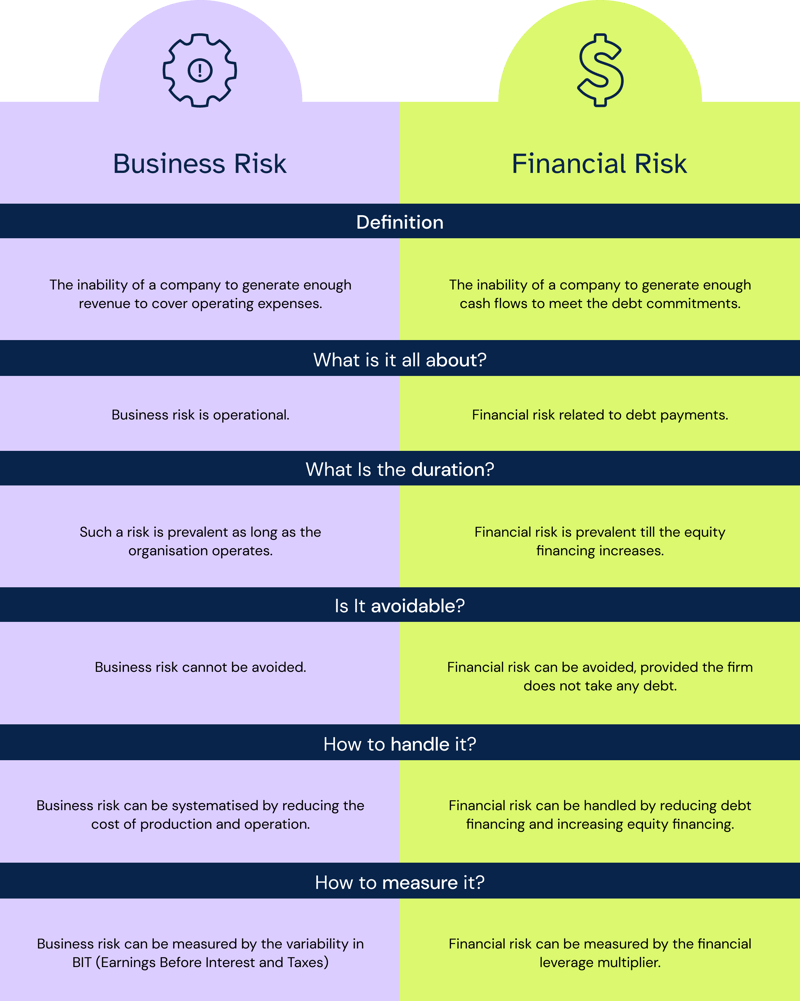

The difference between a business risk and financial risk

When we say that business risk cannot be avoided, we mean 'completely', obviously. Sometimes the cause of a risk is external to the company. As for being completely debt free and avoiding 100% of financial risk, if you manage to do it, let the rest of us know how won't you?

Here's an example of the difference between a business risk and financial risk.

For both of these key risk domains, there is certainly a lot you can do to start at least giving yourself the best chance possible to mitigate them.

Calculating risk with 6clicks

And here it is. Start with a comprehensive risk review. Our mobile app puts a well-timed grenade under the tediously boring and not to mention damaging old-school methods of risk reviews. Also, we believe it is the only real way to get a solid review done that represents the true risk landscape of your business.

You can access risk libraries curated by industry experts, or simply drive risk awareness with our tailored newsfeed based on your risk profile with 6clicks Pulse.

Book a demo below with one of our friendly team members today to learn more.

Explore the 6clicks solution for enterprise risk management here.

Related useful resources

Written by Dr. Heather Buker

Heather has been a technical SME in the cybersecurity field her entire career from developing cybersecurity software to consulting, service delivery, architecting, and product management across most industry verticals. An engineer by trade, Heather specializes in translating business needs and facilitating solutions to complex cyber and GRC use cases with technology. Heather has a Bachelors in Computer Engineering, Masters in Engineering Management, and a Doctorate in Information Technology with a specialization in information assurance and cybersecurity.