Risk management is a fundamental practice that organizations employ to identify, assess, and mitigate potential threats that may hinder their ability to achieve objectives effectively. A well-structured Risk Management Framework (RMF) provides a systematic and strategic approach to managing risks, enabling organizations to understand their risk exposure and develop appropriate risk management strategies. This comprehensive framework encompasses various types of risks, including legal, operational, strategic, financial, security, and privacy risks, allowing organizations to safeguard their assets, comply with regulatory requirements, and enhance their overall risk posture.

The importance of risk management cannot be overstated, as it plays a crucial role in protecting organizations from potential harm and ensuring their continued success. By identifying and assessing risks, organizations can take proactive steps to control or mitigate their impact, preventing financial losses, maintaining their reputation, and ensuring the safety and well-being of employees and customers. Moreover, effective risk management empowers organizations to comply with legal and regulatory requirements, providing decision-makers with a comprehensive and accurate understanding of potential risks and opportunities.

Implementing a robust risk management framework brings numerous benefits to organizations. It allows them to prioritize threats, allocate resources efficiently, establish standardized protocols, and ensure effective access controls. By adopting such a framework, organizations can proactively manage risks, protect their assets, and enhance their overall security posture.

In this blog, we will explore the core components of a risk management framework, the importance of monitoring and reporting risks and controls, the various types of risks organizations face, including strategic, operational, financial, compliance, reputational, and non-core risks. Additionally, we will delve into the emerging trends in risk management and the role of risk management software in streamlining and optimizing the risk management process. Embracing these principles and practices will enable organizations to navigate uncertainties confidently and cultivate a resilient and sustainable future.

Definition of Risk Management Framework

A Risk Management Framework (RMF) is a structured process that government agencies and organizations use to identify, assess, and mitigate risks to achieve their objectives effectively. It provides a systematic and strategic approach to risk management, enabling organizations to understand their risk exposure and develop appropriate risk management strategies. The RMF consists of core components such as risk identification, risk assessment, risk mitigation strategy, and security controls. It encompasses various types of risks, including legal, operational, strategic, financial, security, and privacy risks. By implementing an effective risk management framework, organizations can proactively manage potential threats, comply with regulatory requirements, protect their intellectual property, and enhance their overall risk posture.

Why is risk management important?

Risk management is important because it helps organizations identify and prioritize risks that could potentially interfere with their ability to operate effectively and achieve their objectives.

By identifying and assessing risks, organizations can take steps to control or mitigate those risks, which can help prevent or minimize the negative impacts they might have on the organization. This can help organizations avoid financial losses, maintain their reputation, and ensure their employees' and customers' safety and well-being.

In addition, effective risk management can help organizations to comply with legal and regulatory requirements and can support decision-making by providing a more complete and accurate picture of the potential risks and opportunities facing the organization.

Benefits of a Risk Management Framework

There are several benefits of implementing effective risk management processes in an organization. These can include:

- Avoiding financial losses: By identifying and managing risks, organizations can avoid or minimize potential financial losses. This can help to protect the organization's capital and earnings and can support long-term financial stability and growth.

- Maintaining reputation: Effective risk management can also help organizations to maintain their reputation by reducing the likelihood of negative events, such as accidents, lawsuits, or regulatory violations. This can help to protect the organization's brand and reputation and can support customer trust and loyalty.

- Ensuring safety and well-being: Risk management can also help organizations to ensure the safety and well-being of their employees and customers. By identifying and controlling potential hazards, organizations can prevent accidents and injuries and can support a positive and healthy work environment.

- Supporting decision-making: Risk management can also support decision-making by providing a more complete and accurate picture of the potential risks and opportunities facing the organization. This can help to inform strategic planning and decision-making and can support the development of more effective and efficient operations.

- Complying with legal and regulatory requirements: Effective risk management can also help organizations to comply with legal and regulatory requirements. By identifying and managing risks, organizations can ensure that they are meeting their obligations, and can avoid potential penalties or fines.

Components of a Risk Management Framework

The components of a risk management framework consist of several essential elements that work together to ensure effective risk governance and management. These components include risk identification, risk assessment, risk mitigation strategy, and risk management processes.

Risk identification is the first step in the risk management framework. It involves identifying and documenting potential risks and threats that may impact an organization's operations, objectives, and reputation. This process requires in-depth analysis of internal and external factors that could increase the likelihood of risks occurring.

Risk assessment involves evaluating the identified risks to determine their potential impact on the organization. This includes assessing the likelihood of the risks occurring and the potential severity of their consequences. By understanding the level of risk exposure, organizations can prioritize resources and implement appropriate risk management strategies.

A risk mitigation strategy is developed based on the assessment of risks. This strategy outlines the actions and controls that will be implemented to reduce or eliminate the identified risks. Organizations may implement a variety of risk mitigation techniques, including implementing security controls, developing contingency plans, or transferring risks through insurance.

Risk management processes are the structured procedures and activities that organizations follow to manage and monitor risks. This includes regular risk reporting and communication, ongoing risk measurement and monitoring, and reviewing and updating risk management plans as needed. These processes ensure that organizations have an effective framework in place to address current and future risks.

A well-designed risk management framework consists of key components such as risk identification, risk assessment, risk mitigation strategy, and risk management processes. By following these components, organizations can proactively identify and manage potential risks and protect their assets from various threats.

Risk identification

Risk identification is a crucial step within the risk management framework, aimed at identifying and documenting potential risks that may impact an organization. This process involves brainstorming and analyzing various factors, such as threats, vulnerabilities, impact, likelihood, and predisposing conditions, to identify all possible risks.

During the risk identification process, organizations examine risks from both a strategic and asset-focused level. Strategic risks refer to risks that may affect the overall goals and objectives of the organization. These risks may include compliance risks, which involve the organization's adherence to laws and regulations; financial risks related to budgeting, investments, or economic fluctuations; legal risks associated with lawsuits, contract breaches, or intellectual property infringement; and operational risks that impact the efficiency and effectiveness of the organization's processes.

On the other hand, asset-focused risks pertain to specific assets or systems within the organization. Examples of asset-focused risks include IT risks, such as data breaches or system failures; privacy risks, involving protecting personal and sensitive information; and operational risks, such as supply chain disruptions or equipment failures.

By conducting a comprehensive risk identification process, organizations can prioritize risks based on their potential impact and likelihood, enabling them to allocate resources and develop appropriate risk management strategies. This structured approach to risk identification ensures that organizations clearly understand the risks they face and can take proactive measures to mitigate them.

Risk assessment

Risk assessment is a crucial component of an effective risk management framework, as it enables businesses to understand and prioritize the identified risks. This process involves creating a risk profile for each identified risk, which includes gathering relevant information about the risk, such as threats, vulnerabilities, impact, likelihood, and predisposing conditions.

To calculate and rank the risks, businesses need to analyze the potential threats that could exploit the vulnerabilities associated with each risk. This involves assessing the likelihood of each threat occurring and its impact on the organization if it were to materialize. Additionally, businesses need to consider any predisposing conditions that may increase the risk's likelihood or impact.

Once the risks have been calculated and ranked, businesses can determine the level of risk exposure they face and prioritize their risk management efforts accordingly. It is important to measure specific risk exposure to understand the potential impact on the organization's objectives. This includes assessing the magnitude of potential losses and considering diversification benefits.

Common aggregate risk measures such as value-at-risk (VaR) and earnings-at-risk (EaR) can be utilized to quantify and communicate the potential losses associated with specific risks. These measures help organizations make informed decisions about risk mitigation strategies and allocate resources effectively.

Risk assessment plays a crucial role in the risk management framework. It allows businesses to create a risk profile, calculate and rank risks, and measure their specific risk exposure. Organizations can make informed decisions and implement appropriate risk mitigation strategies by understanding the threats, vulnerabilities, and potential impact of each risk.

Risk mitigation strategy

Once the risks have been identified and ranked, businesses can proceed to develop a risk mitigation strategy based on the information gathered. This strategy aims to minimize the impact or likelihood of the identified risks on the organization.

One commonly used risk mitigation strategy is insurance. Businesses can protect themselves financially from potential losses by transferring the risk to an insurance provider. Insurance policies can cover many risks, including property damage, liability claims, or cyber-attacks.

Another strategy is diversification, which involves spreading investments or business activities across different sectors or regions. By diversifying, businesses reduce their exposure to a single risk and increase the chances of positive outcomes. For example, a company may diversify its product portfolio or expand into multiple markets to mitigate the risk of relying heavily on a single product or market segment.

The sale of assets or liabilities is another risk mitigation strategy. Businesses can reduce their overall risk exposure by offloading certain assets or liabilities. This may involve selling non-core assets or divesting from underperforming business units.

Hedging with derivatives is another technique used to mitigate risks. Businesses can utilize financial instruments such as options, futures, or swaps to offset potential losses caused by market volatility or price fluctuations.

In some cases, organizations may opt to retain core risks if they believe they have the necessary expertise and capacity to manage them effectively. This strategy involves accepting certain risks and implementing risk management measures internally.

Overall, developing a risk mitigation strategy involves carefully considering the identified risks and selecting the appropriate techniques such as insurance, diversification, sale of assets or liabilities, hedging with derivatives, or retaining core risks to minimize the potential impact on the organization.

Security controls and measures

Security controls and measures are integral to the Risk Management Framework (RMF) to manage and mitigate risks effectively. These controls are critical in safeguarding an organization's information and assets from potential threats and vulnerabilities.

The RMF outlines a structured process for implementing and assessing security controls. These controls are designed to protect against a wide range of risks, including security breaches, data breaches, privacy risks, and regulatory risks. They encompass both technical and administrative safeguards, such as access controls, encryption, intrusion detection systems, and security awareness training.

Assessment of security controls involves evaluating their functionality and compliance with specific requirements, such as industry standards or regulatory guidelines. This assessment is typically carried out through various activities, including audits, vulnerability assessments, testing, and monitoring.

If any weaknesses or deficiencies are identified during the assessment, it is crucial to address them promptly. This may involve implementing additional controls, modifying existing controls, or enhancing security measures. The objective is to continuously improve the effectiveness and efficiency of the security controls to ensure that the organization's risk exposure is minimized.

By implementing and continuously assessing security controls, organizations can enhance their overall risk management practices, protect their valuable assets, and maintain compliance with legal and regulatory requirements. This approach to risk management helps organizations to proactively identify and manage potential risks, contributing to the overall security and resilience of the organization.

Monitoring and reporting of risks and controls

Monitoring and reporting of risks and controls are vital components of a robust risk management framework. Organizations need to have a clear understanding of the risks they face and how effectively their controls are mitigating those risks. This ongoing monitoring helps to ensure compliance with policies, regulations, and industry standards, protecting the organization from potential harm.

Maintaining a comprehensive list of known risks allows organizations to prioritize and allocate resources effectively. By regularly monitoring these risks, organizations can identify any changes or emerging risks that may require immediate attention. This proactive approach helps to minimize the likelihood of a risk turning into a crisis.

Additionally, monitoring the effectiveness of risk mitigation controls is essential. Organizations must continuously assess the performance and efficiency of these controls to ensure they are operating as intended. Regular monitoring also allows for the identification of any control weaknesses or deficiencies so that corrective actions can be taken promptly.

Reporting the outcomes of risk monitoring to appropriate stakeholders, such as senior leadership or the board of directors, is critical. These stakeholders need to be informed about the organization's current risk landscape, the effectiveness of existing controls, and any emerging trends or threats. By providing accurate and timely risk information, organizations can enable informed decision-making and ensure that risk management strategies align with the overall business objectives.

Monitoring and reporting of risks and controls within a risk management framework are essential for maintaining compliance, identifying emerging risks, and making informed decisions. By continuously assessing and reporting on risks and controls, organizations can effectively mitigate potential harm and safeguard the organization's interests.

Types of risks in organizations and non-core risks

Effective risk management requires organizations to have a clear understanding of the various types of risks they may encounter. By identifying and categorizing potential risks, organizations can develop targeted strategies and controls to mitigate their impact. Let's explore the different types of risks that organizations may face and how they can be managed.

-

Strategic Risks: Strategic risks refer to uncertainties and potential threats that can impact an organization's ability to achieve its long-term goals and objectives. These risks often arise from external factors such as changes in market conditions, shifts in consumer preferences, or disruptive innovations. Strategic risk management involves scenario planning, market analysis, and continuous monitoring to identify and respond to potential threats and opportunities.

-

Operational Risks: Operational risks are associated with an organisation's day-to-day activities and processes. These risks encompass a wide range of factors, including human error, system failures, supply chain disruptions, and product defects. Effective operational risk management involves implementing robust internal controls, process optimization, and employee training to minimize the likelihood and impact of operational failures.

-

Financial Risks: Financial risks relate to an organization's financial stability and performance. Examples of financial risks include market, credit, liquidity, and currency exchange risks. Financial risk management strategies may involve diversification of investments, hedging strategies, and stress testing to ensure the organization's financial health and resilience.

-

Compliance Risks: Compliance risks arise from non-compliance with laws, regulations, and industry standards applicable to an organization's operations. Failure to meet compliance requirements can lead to legal disputes, penalties, reputational damage, and loss of trust from stakeholders. Compliance risk management includes developing robust compliance programs, conducting regular audits, and keeping track of regulatory changes to ensure adherence to legal and ethical standards.

-

Reputational Risks: Reputational risks refer to threats damaging an organization's reputation and brand image. These risks can arise from negative publicity, customer complaints, ethical breaches, or social media backlash. Proactive reputation risk management involves building strong relationships with stakeholders, transparency in communication, and swift and sincere responses to potential reputation-damaging events.

In addition to the core risks mentioned above, organizations need to be aware of non-core risks that may not directly relate to their primary business activities but can still have significant impacts. These risks can stem from external factors and can affect various aspects of an organization's operations. Managing non-core risks is essential for maintaining overall organizational resilience and safeguarding long-term success.

-

Supply Chain Risks: Organizations often rely on complex supply chains to deliver goods and services to their customers. Disruptions in the supply chain, such as natural disasters, transportation issues, or supplier failures, can significantly impact a company's ability to deliver on time and meet customer demand. By mapping supply chains, diversifying suppliers, and implementing contingency plans, organizations can mitigate supply chain risks.

-

Regulatory Risks: Regulatory requirements and compliance obligations can vary across industries and jurisdictions. Failure to comply with these regulations can result in fines, legal actions, or reputational damage. Organizations must stay updated with regulatory changes, establish compliance frameworks, and conduct regular audits to ensure adherence to legal requirements.

-

Privacy and Data Security Risks: In the digital age, organizations face the risk of data breaches, unauthorized access to sensitive information, and violations of privacy laws. Implementing robust cybersecurity measures, data encryption, and employee training on data protection are essential for managing privacy and data security risks.

-

Cyber Risks: Cyber attacks, such as ransomware attacks, phishing attempts, and malware infections, pose significant threats to organizations' data, operations, and finances. Organizations need to invest in cybersecurity defenses, conduct regular vulnerability assessments, and educate employees about cybersecurity best practices to prevent and respond effectively to cyber risks.

-

Environmental Risks: Environmental risks refer to threats arising from climate change, natural disasters, or ecological issues. These risks can disrupt operations, damage property, and impact an organization's reputation. Implementing sustainable practices, conducting environmental impact assessments, and having disaster recovery plans can help mitigate environmental risks.

By proactively identifying and managing non-core risks, organizations can strengthen their overall risk management approach and improve their ability to withstand unexpected challenges. Effectively addressing both core and non-core risks ensures comprehensive protection for the organization and supports sustainable growth and success.

What are the risk management trends?

There are several trends in risk management that are currently shaping the field. Some of the most significant trends include:

- The increasing use of technology: One of the main trends in risk management is the increasing use of technology to support risk management processes. This includes the use of software tools and systems to automate data collection and analysis, as well as the use of advanced analytics and machine learning to improve the accuracy and speed of risk assessments.

- The growing importance of cybersecurity: Another trend in risk management is the growing importance of cybersecurity. With the increasing reliance on technology and the rise of cyber threats, organizations are placing a greater emphasis on managing risks related to information security and data protection.

- The expanding role of risk management: Another trend is the expanding role of risk management within organizations. In the past, risk management was often seen as a separate function, but today it is increasingly being integrated into strategic planning and decision-making at all levels of the organization.

- The focus on enterprise-wide risk management: Another trend is the shift towards enterprise-wide risk management, which involves managing risks across the entire organization rather than just within individual departments or business units. This requires a more holistic and integrated risk management approach and can help identify and manage risks more effectively.

- The increasing importance of sustainability: Finally, another trend in risk management is the growing emphasis on sustainability. This includes managing risks related to environmental, social, and governance (ESG) issues and can help organizations to support long-term value creation and reduce their negative impacts on the environment and society.

What is risk management software?

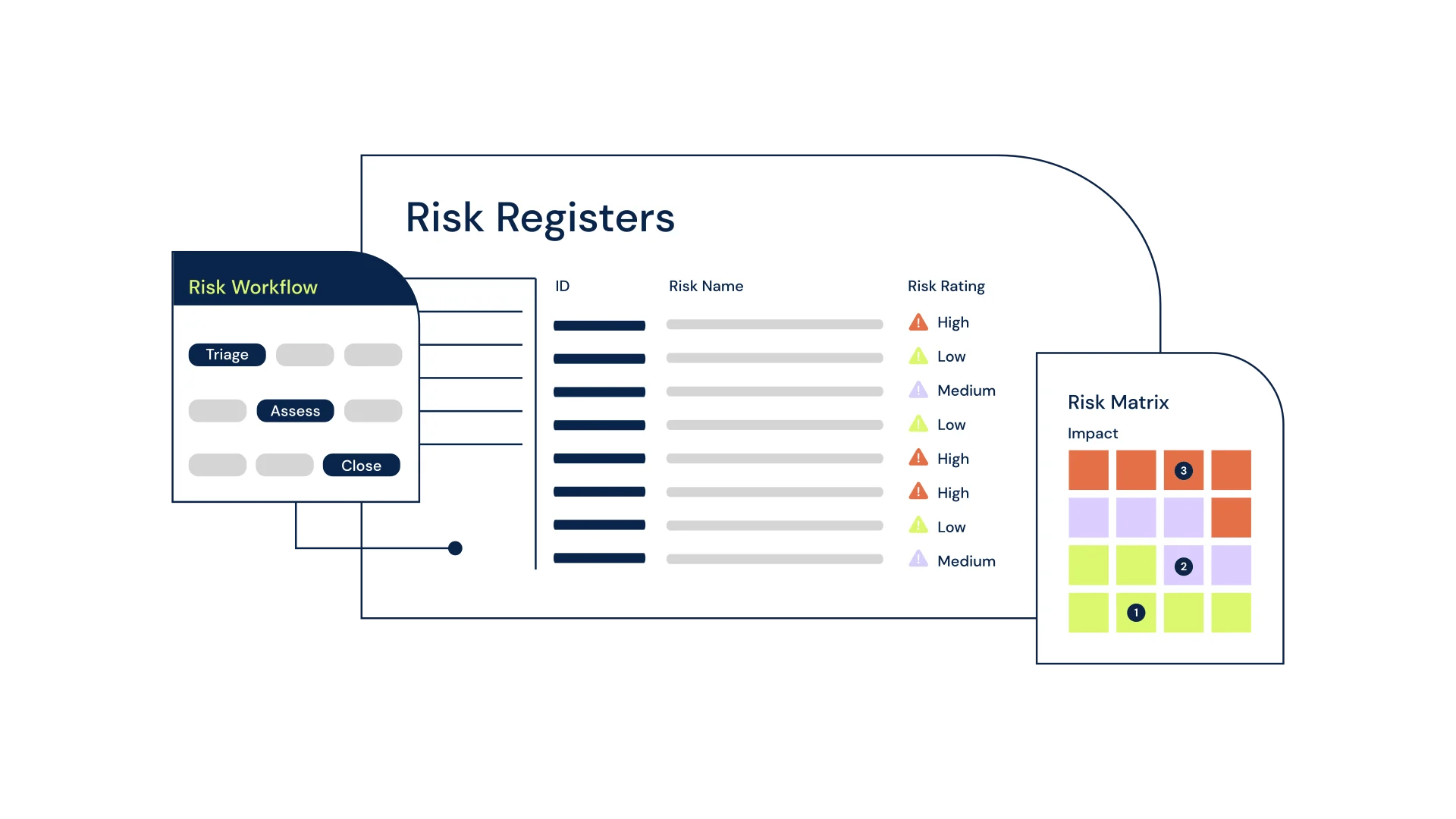

Risk management software is a type of software that is designed to help organizations manage their risks. This can include activities such as identifying potential risks, assessing their likelihood and impact, developing risk management plans, and implementing controls to prevent or mitigate them. Risk management software also provides a central platform for managing risks, and it can help to automate many of the processes involved in risk management, such as data collection and analysis, reporting, and tracking.

6clicks provides a unified platform that brings together all the activities related to risk management in one place. With automation and AI, the seemingly complex processes under risk management are simplified to a great extent. Want to see how 6clicks helps improve your overall risk posture?

Written by Dr. Heather Buker

Heather has been a technical SME in the cybersecurity field her entire career from developing cybersecurity software to consulting, service delivery, architecting, and product management across most industry verticals. An engineer by trade, Heather specializes in translating business needs and facilitating solutions to complex cyber and GRC use cases with technology. Heather has a Bachelors in Computer Engineering, Masters in Engineering Management, and a Doctorate in Information Technology with a specialization in information assurance and cybersecurity.